In Financial Planning & Analysis (FP&A), transforming financial data into actionable plans often requires breaking down large figures into smaller, more manageable components. Annual budgets are converted into monthly projections, overhead costs are allocated to cost centers, and central funds are distributed across business units or projects. To describe these actions, practitioners commonly use terms like allocation, spreading, and distribution. While these techniques are foundational to effective planning, they are often used interchangeably—leading to inconsistencies in models, workflows, and reports. Understanding the distinctions among these terms is critical for building clarity and precision in FP&A processes. This article breaks down each concept with practical examples to illustrate their unique applications and value in financial planning.

Allocation is the process of assigning indirect costs (like corporate overheads, rent, utilities) or sometimes shared revenues, from a central pool to specific destinations like cost centers, departments, product lines, or projects. Think of it as fairly dividing up shared expenses among those who consumed the resources or benefited from them.

Why we do it: The primary goal is to determine a more accurate full cost of running a department, producing a product, or delivering a service. This enables meaningful profitability analysis, helps justify internal chargebacks, and can encourage more efficient use of shared resources.

How it works: Allocation relies on a logical allocation basis or driver that reflects the consumption or benefit received. Common drivers include employee headcount, square footage occupied, machine hours used, direct labor hours, IT tickets logged, or more complex Activity-Based Costing (ABC) methodologies.

Simple Example: Imagine a company's central IT helpdesk costs $100,000 per month. This needs to be allocated to the Sales, Marketing, and Operations departments based on usage, approximated by employee headcount.

The allocation would be:

Spreading, often called Phasing, involves taking a total budget or forecast amount for a longer duration (like a year or quarter) and distributing it across shorter, sequential time periods (like months or weeks).

Why we do it: Spreading creates realistic periodic targets essential for operational management and performance tracking. It helps align financial plans with business seasonality, project timelines, or specific events, leading to more accurate cash flow forecasts and resource planning.

How it works: This uses various spreading methods or curves. The simplest is an "even spread" (total divided by periods). More sophisticated methods use historical data patterns, specific seasonality factors (e.g., higher sales in festive months), predefined project curves (like an S-curve), or allow for manual adjustments based on planned activities.

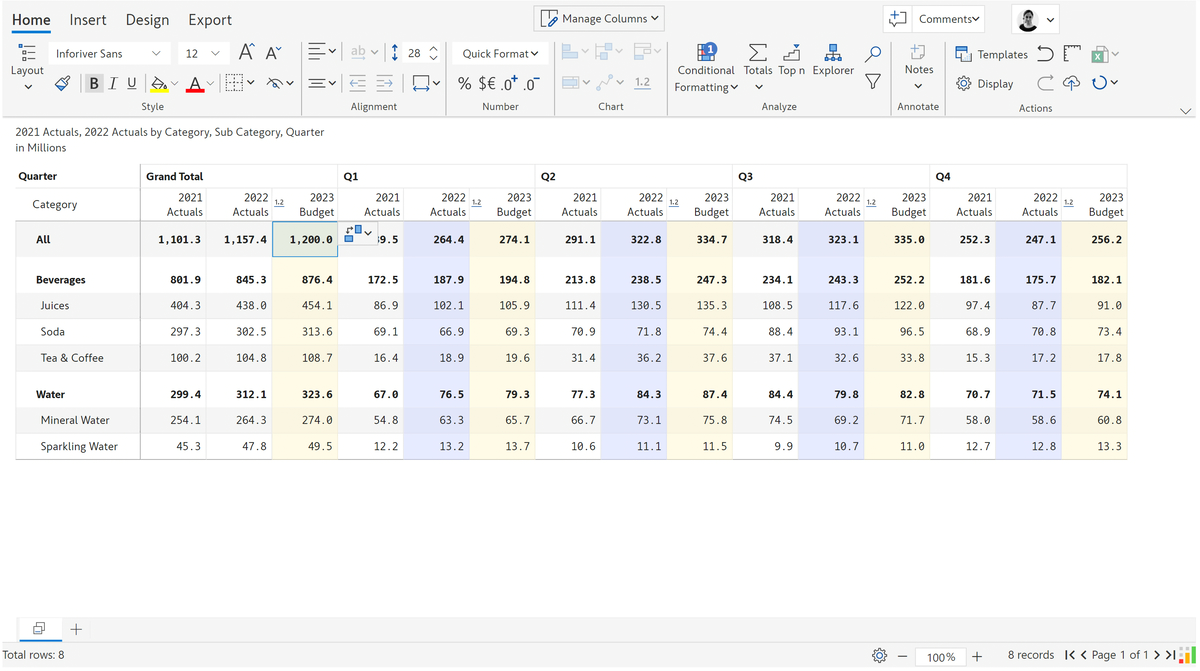

Simple Example: A company approves an annual marketing budget of $1,200,000. Spreading this evenly would result in $100,000 per month. However, knowing a major product launch campaign will run heavily in Q4 (Oct-Dec), a seasonal spread based on planned activity might be more appropriate:

Distribution is often used as a more general term for dividing a total amount across multiple categories or dimensions based on specific distribution keys, percentages, weights, or predefined business rules. While it can sometimes achieve a similar outcome to allocation, the basis is often a predefined key rather than a consumption driver.

Why we do it: Distribution is used to apportion funds or targets based on agreed-upon logic, break down high-level figures for reporting, or assign values based on relative contribution or predefined shares.

How it works: It relies on distribution keys – these could be fixed percentages, relative weights derived from another metric (like prior year sales mix), lookup tables mapping categories to portions, or other specific rules defined by the business.

Simple Example: A company has a central discretionary project fund of $2,000,000 to be distributed among three strategic initiatives (A, B, C) based on their strategic priority score assigned by leadership:

The distribution would be:

Summary Table: Allocation vs. Spreading vs. Distribution

| Feature | Allocation | Spreading (Phasing) | Distribution |

|---|---|---|---|

| Primary Goal | Assign indirect costs/revenues to cost objects | Distribute totals across time periods | Apportion totals across categories based on keys/rules |

| Focus Dimension | Organizational / Product / Activity | Time (Months, Weeks, Quarters) | Various (Departments, Regions, Categories, etc.) |

| Basis/Mechanism | Drivers (Usage, Headcount, Sq. Ft., ABC) | Time Patterns (Even, Seasonal, Curves, History) | Keys, Percentages, Weights, Business Rules |

| Typical Use | Full Costing, Profitability Analysis | Periodic Budgeting, Seasonality, Cash Flow Forecast | Targeted Apportionment, Bonus Pools, Fund Division |

Using these terms precisely is more than just semantics in FP&A:

Overall, these three methods - Allocation, Spreading, and Distribution - are fundamental techniques in the FP&A toolkit, each serving a distinct purpose in shaping raw financial data into meaningful plans and analyses.

Allocation assigns indirect value based on drivers; Spreading phases totals across time; and Distribution apportions amounts based on defined keys or rules.

By understanding and applying these concepts correctly, finance professionals can enhance the accuracy of their plans, build trust in their analysis, and ultimately contribute more effectively to strategic decision-making. Precision in language truly reflects precision in process.

Lumel enables enterprises to craft adaptable, data-driven financial plans by leveraging intelligent forecasting, dynamic budgeting, and precise allocation, spreading, and distribution techniques. This empowers confident decision-making in an ever-changing market. The firm was recognized as the best new vendor for EPM in 2024.

To follow our experts and receive industry insights on planning, budgeting and forecasting, register for our latest webinars.