In financial planning and analysis, the terms budget and forecast are often used together—but they are not interchangeable. Each plays a distinct role in managing performance and guiding business strategy. A budget is a structured financial plan built around targets, resource allocation, and expected outcomes over a fixed period, typically set at the beginning of a fiscal year. It serves as a baseline for evaluating performance against planned objectives.

A forecast, on the other hand, is a dynamic projection based on actuals and updated assumptions. It provides a forward-looking view that helps organizations adapt to changing conditions, manage risk, and refine their course of action. For professionals in finance, planning, and analytics, clearly differentiating between budgets and forecasts is critical for maintaining financial agility and ensuring that decision-makers have timely, data-driven insights.

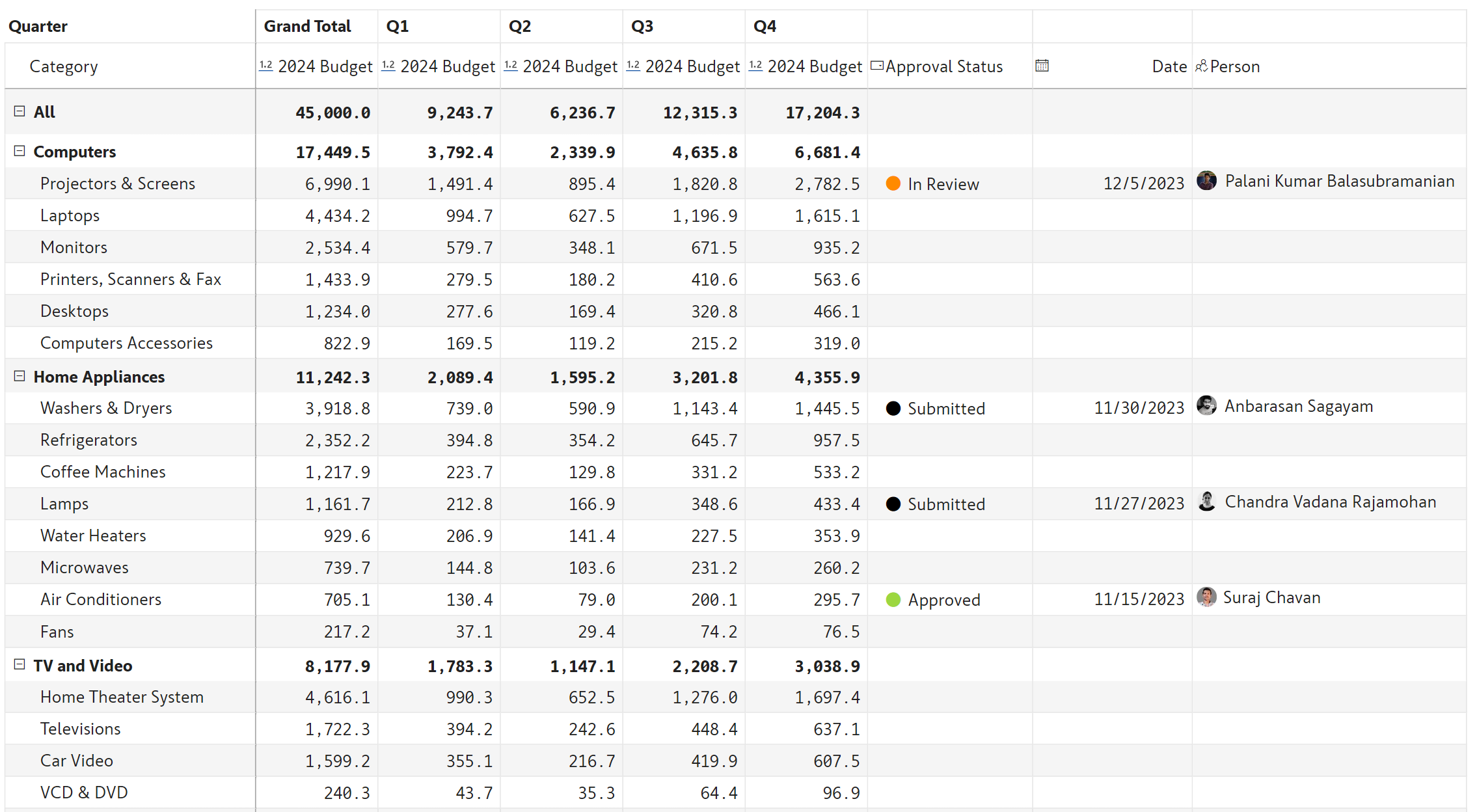

A Budget is essentially your company's detailed financial plan for a specific future period, most commonly a year. It outlines expected income (revenue) and planned expenditures (costs) based on your goals and strategic objectives.

Think of the budget as:

"What we plan or intend to happen."

Its main jobs include:

A budget is typically created before the period begins (often through an annual budgeting process) and, once approved, tends to be relatively static. While some businesses use flexible budgets, many traditional budgets serve as a fixed benchmark for the duration of the period. It's the financial expression of your operational plan and strategic priorities.

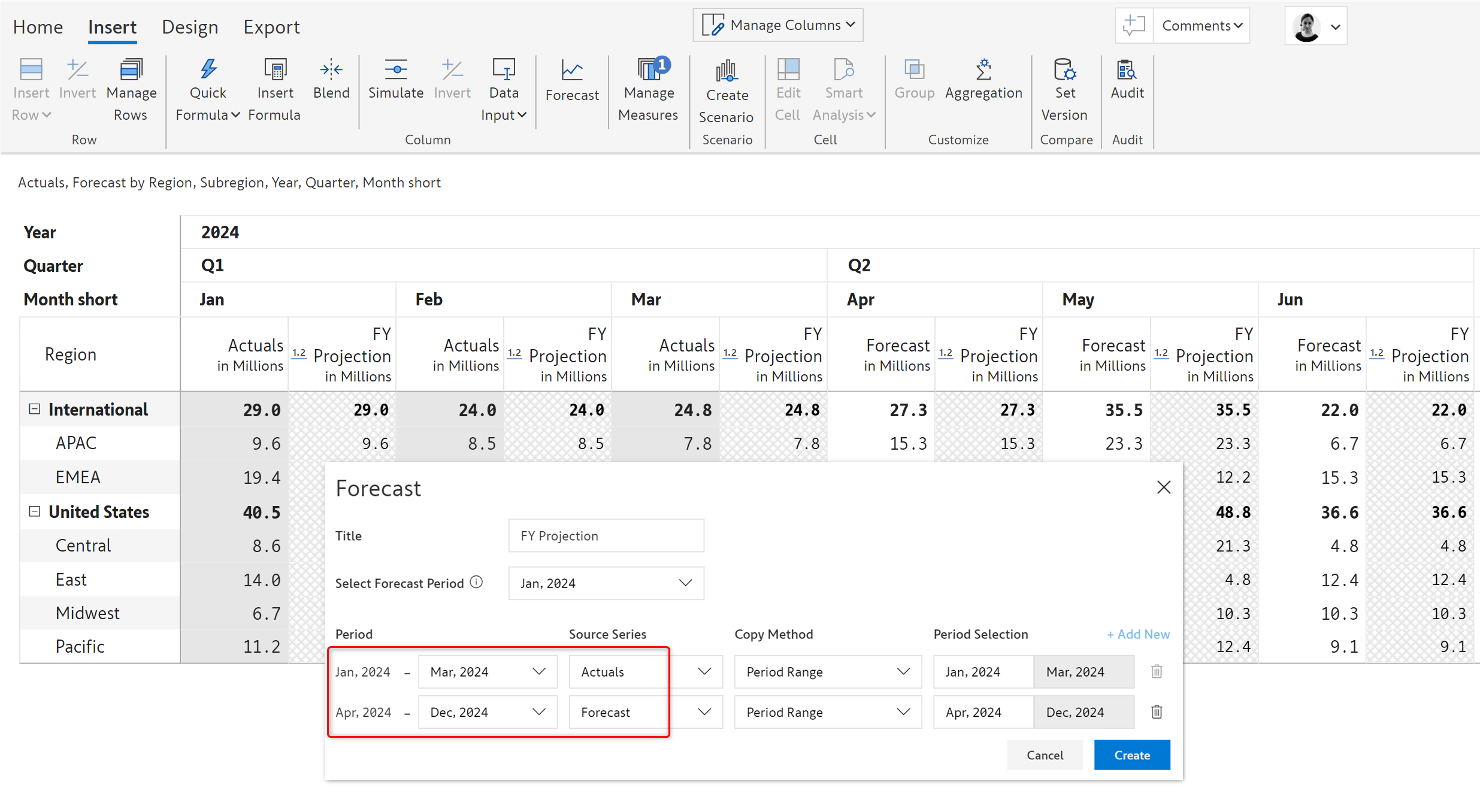

A Forecast, on the other hand, is your prediction of future financial outcomes. It uses historical data, current performance trends, and insights about anticipated future events (like market changes, new competitor actions, or upcoming sales campaigns) to estimate what's likely to happen financially.

Think of the forecast as:

"What we think is likely to happen."

Its main roles involve:

Unlike a budget, a forecast is dynamic. It should be updated regularly – perhaps weekly or monthly – to reflect new information and changing business conditions. A forecast helps you understand if you're still on track to meet your budget goals and provides the foresight needed to make course corrections.

While both deal with future finances, their purpose, timing, and focus differ significantly. Here’s a quick comparison:

| Feature | Budget | Forecast |

|---|---|---|

| Primary Goal | Plan / Set Targets / Control Spending | Predict / Estimate Outcomes / Inform Decisions |

| Nature | Often Static (set for a period) | Dynamic (updated regularly) |

| Focus | What you want to happen (goals) | What you think will happen (likely outcome) |

| Time Horizon | Typically Fixed (e.g., annual) | Can be Short or Long-term, updated often |

| Basis | Strategic Goals, Operational Plan | Current Data, Trends, Future Expectations |

| Main Use | Measure Performance Against Plan | Guide Near-Term Actions & Adjustments |

Essentially, the budget is your financial roadmap, while the forecast is your ongoing check on whether you're following the map and if the road conditions ahead require a detour.

It’s crucial to understand that budgets and forecasts aren't competing concepts; they are complementary tools that work best in tandem.

Think about it: Without a budget, your forecast lacks context. What are you predicting against? Without a forecast, your budget quickly becomes irrelevant as soon as business conditions deviate from the original assumptions.

Here’s a practical example:

So, what's the verdict in the Budget vs Forecast discussion? They both play vital roles.

Understanding the distinct purpose of each allows your business to leverage them effectively. You need the plan (the budget) to know where you're aiming, and you need the ongoing predictions (the forecast) to make the smart adjustments needed to get there, especially when the winds inevitably change. Using both, consistently and correctly, is fundamental to strong financial management and steering your business towards success.

Lumel empowers finance, planning, and analytics teams with intuitive tools for budgeting, forecasting, and reporting—helping you move from static plans to agile, data-driven decision-making. By clearly understanding the differences between budgets and forecasts, your organization can plan with confidence, respond with speed, and stay aligned with strategic goals. The firm was recognized as the best new vendor for EPM in 2024.

To follow our experts and receive industry insights on planning, budgeting and forecasting, register for our latest webinars.