Accurate sales forecasting plays a critical role in financial planning, resource allocation, and business strategy. For finance, planning, and analytics professionals, the ability to anticipate future revenue helps inform budgeting, staffing, and inventory decisions—ultimately driving more confident, data-backed decision-making. At its core, sales forecasting is the practice of estimating future revenue based on historical data, market trends, and business insights.

However, choosing the right forecasting approach isn’t always straightforward. Methods that work well for one industry or company stage may fall short in another. In this post, we’ll explore common forecasting techniques and how to tailor them to your business context.

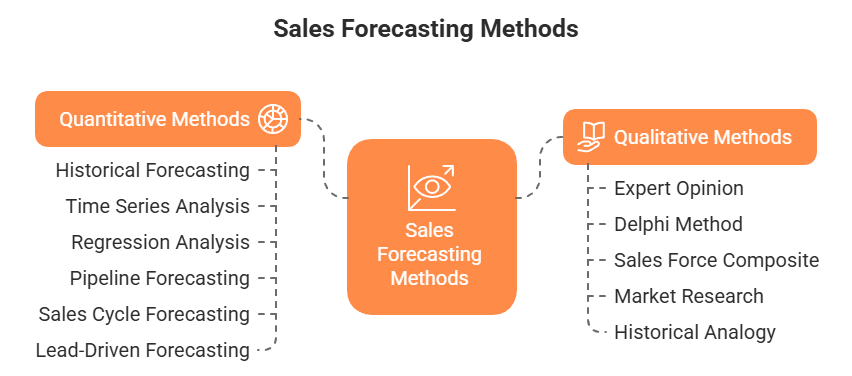

Most forecasting methods fall into two main camps:

And of course, many smart businesses use a Hybrid Approach, blending the art and science for a more well-rounded view.

When hard numbers are scarce, these methods rely on human expertise.

1. Expert Opinion / Jury of Executive Opinion

Imagine getting your company's seasoned leaders – from sales, marketing, finance, maybe even operations – in a room. This method taps into their collective wisdom and experience to arrive at a forecast.

2. The Delphi Method

This one's a bit more structured than just a roundtable chat. It involves a panel of experts who anonymously provide their forecasts. A facilitator then summarizes these, shares the aggregated view (still anonymously), and lets the experts revise their estimates. Repeat a few times, and you often get a surprisingly robust consensus.

3. Sales Force Composite (The "Boots on the Ground" View)

Who knows your customers and deals better than your sales team? This method aggregates forecasts right from the source – individual salespeople estimate what they think they'll close, and these numbers are rolled up by sales managers.

4. Market Research & Customer Surveys

Why guess what customers will do when you can (kind of) ask them? This involves using surveys, focus groups, and broader market analysis to gauge potential demand, customer buying intentions, and even competitor activity.

5. Historical Analogy

Got a brand-new product with zero sales history? This method involves looking at the sales trajectory of a similar product launched in the past (either by your company or a competitor) and using that as a template.

When you've got data, these methods help you crunch the numbers for a more objective view.

1. Historical Forecasting (The "Naive" or "Run Rate" Method)

This is often the simplest starting point. It assumes that what happened in the past will happen again. For example, next month's sales will be the same as last month's, or this quarter's sales will be the same as this quarter last year (perhaps with a little growth kicker).

2. Time Series Analysis

This is a step up from basic historical forecasting. It involves digging into your past sales data to identify underlying patterns like:

Let’s look at the types of firms who would use this.

3. Regression Analysis (Causal Models)

Now we're getting fancy! Regression tries to find a statistical relationship between your sales (the dependent variable) and other factors that might influence them (the independent variables). These factors could be anything from your marketing spend and website traffic to economic indicators like GDP growth or even competitor pricing.

4. Pipeline Forecasting / Opportunity Stage Forecasting

This method looks at the deals currently cooking in your sales pipeline. Each stage in your sales process (e.g., "Initial Contact," "Demo Done," "Proposal Sent," "Negotiation") is assigned a probability of closing. You then multiply each deal's potential value by its stage probability to get a weighted forecast.

5. Length of Sales Cycle Forecasting

How long does it typically take for a prospect to go from "Hello" to "Here's my money"? This method uses that average sales cycle length to predict when current opportunities might close based on how long they've already been in the pipeline.

6. Lead-Driven Forecasting / Lead Value Forecasting

This one connects your marketing efforts directly to your sales forecast. It looks at the number and quality of leads you're generating, their historical conversion rates (how many turn into actual sales), and the average value of deals from different lead sources.

Often, the smartest path isn't strictly art or science, but a bit of both. A hybrid approach might involve, for example, starting with a quantitative time-series forecast, then having the sales team overlay their pipeline insights, and finally getting executive input to adjust for strategic initiatives or major market shifts.

Callout: "Don't be afraid to mix and match! The most robust forecasts often come from a blend of data-driven insights and human expertise."

Quick Look: Sales Forecasting Methods - Pros & Cons

| Forecasting Method | Brief Description | Pros | Cons | Who Uses it? | |

|---|---|---|---|---|---|

| QUALITATIVE METHODS | |||||

| 1. | Expert Opinion | Collective wisdom of key executives. | Quick, leverages experience. | Can be biased, lacks statistical rigor. | Startups (Tech, Biotech, etc.), B2B (Aerospace, Heavy Industrial Equipment for novel initiatives/large deals), Professional Services (bespoke projects). |

| 2. | Delphi Method | Structured anonymous expert consensus. | Reduces individual bias, systematic. | Time-consuming, relies on expert participation. | Technology (predicting tech shifts), Energy (resource demand), Healthcare (medical advancements), Public Policy, Education, Tourism. |

| 3. | Sales Force Composite | Aggregating forecasts from salespeople. | Utilizes direct customer knowledge, increases sales team buy-in | Salespeople may be biased (optimism/sandbagging), can be time-consuming. | B2B Software, Industrial Sales, Pharmaceutical Sales, Manufacturing (direct sales), Financial Services (complex B2B products). |

| 4. | Market Research/Surveys | Gathering data on customer buying intentions & market trends | Direct customer insights, useful for new products/market shifts. | Can be expensive, stated intent doesn't always equal action. | Consumer Electronics, Fashion, Automotive, CPG (Consumer Packaged Goods), Pharmaceuticals (new products), Media. |

| 5. | Historical Analogy | Using sales history of a similar past product for a new one. | Useful when no direct historical data exists for the new product. | Relies heavily on finding a truly analogous product; market conditions may differ | Media & Entertainment (new film/show), Publishing (new book), Tech (new software version in an established category), Fashion (similar styles). |

| QUANTITATIVE METHODS | |||||

| 6. | Historical (Naive/Run Rate) | Assumes future sales will be similar to past sales | Simple, quick, easy to understand. | Ignores trends, seasonality, market changes; less accurate in dynamic environments. | Mature CPG (staple products), Utilities, some stable B2B services with recurring revenue, small Retail (for very short term). |

| 7. | Time Series Analysis | Analyzing historical data for trends, seasonality, cycles. | Objective, can identify and predict recurring patterns effectively | Requires significant historical data, can be complex, may not react quickly to sudden disruptions. | Retail (especially seasonal goods), CPG, Hospitality, Tourism, Agriculture, E-commerce, Manufacturing (for established products). |

| 8. | Regression Analysis (Causal) | Identifies relationships between sales and influencing internal/external factors. | Can provide insights into what drives sales, can be highly accurate. | Complex, needs reliable data for all variables, correlation ≠ causation | E-commerce, Retail, Automotive, CPG, Financial Services, any business wanting to quantify impacts of marketing, promotions, or economic factors. |

| 9. | Pipeline Forecasting | Estimates based on current deals in pipeline & their closing probability. | Forward-looking, directly tied to sales activities, easy for sales to grasp. | Accuracy depends on realistic probabilities & stage definitions, subject to salesperson bias. | SaaS, Enterprise Software, Professional Services (Consulting, Agencies), B2B Manufacturing, Financial Services (B2B products), Real Estate (commercial). |

| 10 | Length of Sales Cycle | Uses average time to close a deal to predict current opportunity closures. | Provides time-based perspective, can highlight process bottlenecks. | Assumes consistent sales cycle lengths, which may not always hold true. | High-value B2B (Enterprise Software, Complex Machinery), long-term service contracts, Consulting. |

| 11. | Lead-Driven Forecasting | Forecasts based on lead volume, quality, and historical conversion rates/values. | Directly links marketing to sales outcomes, good for demand-gen focus. | Depends heavily on accurate lead tracking and consistent lead scoring. | SaaS (especially PLG models), E-commerce, Digital Marketing Agencies, Education (student recruitment), any business with strong lead-gen engines. |

So, Which Sales Forecasting Method is Right for You?

Choosing the right sales forecasting method (or, more likely, methods) can feel a bit like Goldilocks trying out porridge. Here are a few things to chew on:

Often, the smartest move is triangulation – using a couple of different methods and seeing if they point in roughly the same direction. If your pipeline forecast says one thing, your historical trend says another, and your sales director has a gut feeling that’s completely different, it’s time for a deeper discussion!

Sales forecasting isn't about having a perfect, infallible prediction. It's about making the most informed estimates possible to guide your business decisions. By understanding the different methods available, you can choose the tools that best fit your unique situation.

And remember, no forecast should be set in stone. The market changes, your business evolves, and your forecasting methods should too. Regular review, a willingness to learn from past inaccuracies, and a spirit of collaboration will always be your best guides. Good luck!

Lumel helps businesses predict better — combining the art and science of sales forecasting to drive confident, data-backed decisions. The firm was recognized as the best new vendor for EPM in 2024.

To follow our experts and receive thought leadership insights on data & analytics, register for one of our webinars.